s corp tax calculator nyc

Start Using MyCorporations S Corporation Tax Savings Calculator. From the authors of Limited Liability Companies for Dummies.

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

However one major difference from c corporations is that the new york city s corporation tax rate is a flat 885as opposed to a range of 65 to 885.

. New York may also require nonprofits to file. Smaller businesses with less net income will only have to pay 65. If New York City Receipts are.

S Corp Tax Savings Discover possible tax savings by comparing S Corp to LLCs in your state. In order to gain New York tax-exempt status a corporation must qualify as a 501c and obtain a Nonprofit Tax-Exempt ID Number from the IRS. There are four tax brackets starting at 3078 on taxable income up to 12000.

But as an S corporation you would only owe self-employment tax on the 60000 in. We are not the biggest. This calculator helps you estimate your potential savings.

This tax is administered by the Federal Insurance Contributions. This guide will quickly teach you the major mechanics of how your taxes and this tax calculator. If youre a solopreneur making at least.

Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022. More than 500000 but. Calculating Your S-Corp Tax Savings is as Easy as 1-2-3.

Ad Payroll So Easy You Can Set It Up Run It Yourself. Ad Payroll So Easy You Can Set It Up Run It Yourself. Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the.

Use this calculator to get started and uncover the tax savings youll. Fixed Dollar Minimum Tax is. Forming an S-corporation can help save taxes.

If New York City Receipts are. You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. Reduce your federal self-employment tax by electing to be treated as an S-Corporation.

This could potentially increase the S-corp tax bill significantly and. Close Corporation Plans stipulate that the surviving partners must purchase all of the shares owned by the. If your business is incorporated in New York State or does.

Forming an S-corporation can help save taxes. S corp vs llc tax savings calculator. Shareholders pay New York tax on their pro rata share of the S corporation pass-through items of income gain loss and deduction that are includable in their federal adjusted.

But as an S. All shareholders who earn wages or a salary from a C Corporation must pay self-employment tax. More than 100000 but not over 250000.

Regardless if youre self-employed or an employee you have to pay Social Security and. As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. Before using the S corp tax calculator you will need to.

Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Close Corporation Plan. 1 Select an answer for each question below and we will calculate your S-corp tax savings.

New Yorks estate tax is based on a graduated rate. This calculator helps you estimate your potential savings. Not more than 100000.

10 -New York Corporate Income Tax Brackets. Our S Corp Tax Rate guide explains how S corp taxes work and how to determine if an S corp is right for your business. Federal Taxes for C Corps.

Taxes Paid Filed - 100 Guarantee. New York Estate Tax. Another way that corporations can be taxed is directly on their business capital less certain liabilities.

For example if you have a. Like the states tax system NYCs local tax rates are progressive and based on income level and filing status. A form of business buy-sell agreement.

You can also use our New York property tax calculator to find out what you would pay in property taxes in New York. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. Taxes Paid Filed - 100 Guarantee.

Lets start significantly lowering your tax bill now. Our S corp tax calculator will estimate whether electing an S corp will result in a tax win for your business. A What is your.

More than 250000 but not over 500000.

New York City Taxes A Quick Primer For Businesses

Student Information Card Template New Frozen Bank Accounts New Economy Project Best Templates Ideas Bes Credit Card Online Bank Account Student Information

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Nyc Transfer Tax What It Is And Who Pays It Streeteasy

Pin By Dan Young On Jesse Splan Coldwell Banker Residential Brokerage Buying A New Home Home Ownership Negotiation Skills

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Real Estate Capital Gains Tax Calculator For Nyc Interactive Hauseit

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

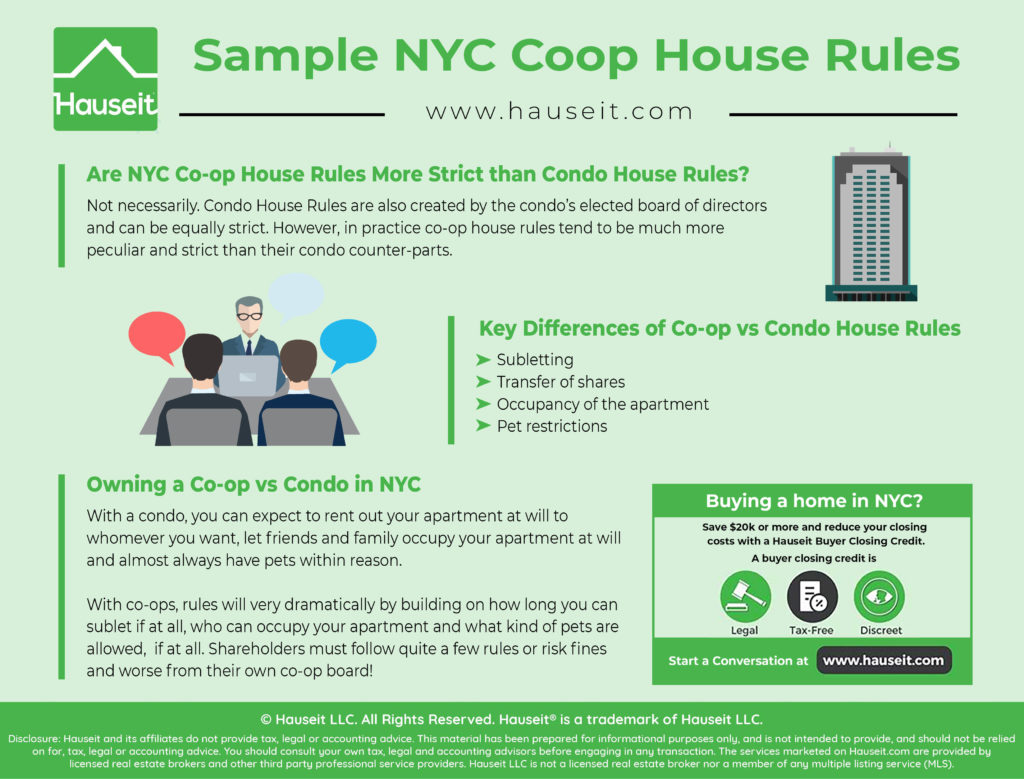

Sample Nyc Coop House Rules Hauseit New York City

How Much Cash To Buy A Co Op Nyc Hauseit Nyc Co Op Cash

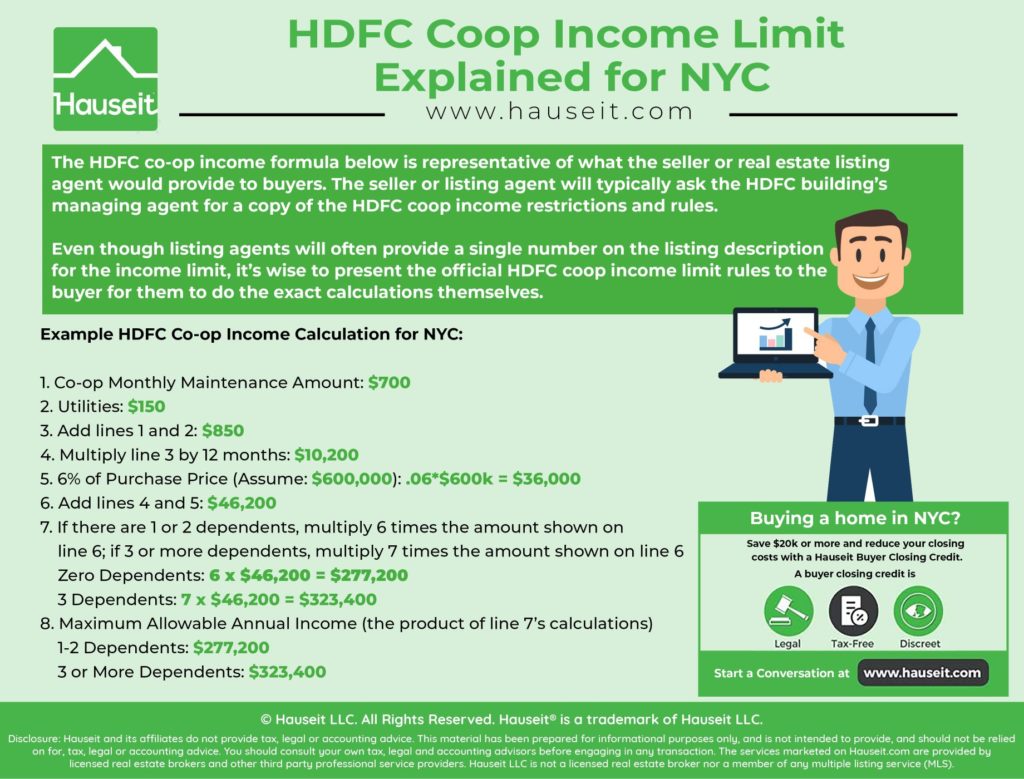

Hdfc Coop Income Limit Explained For Nyc Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

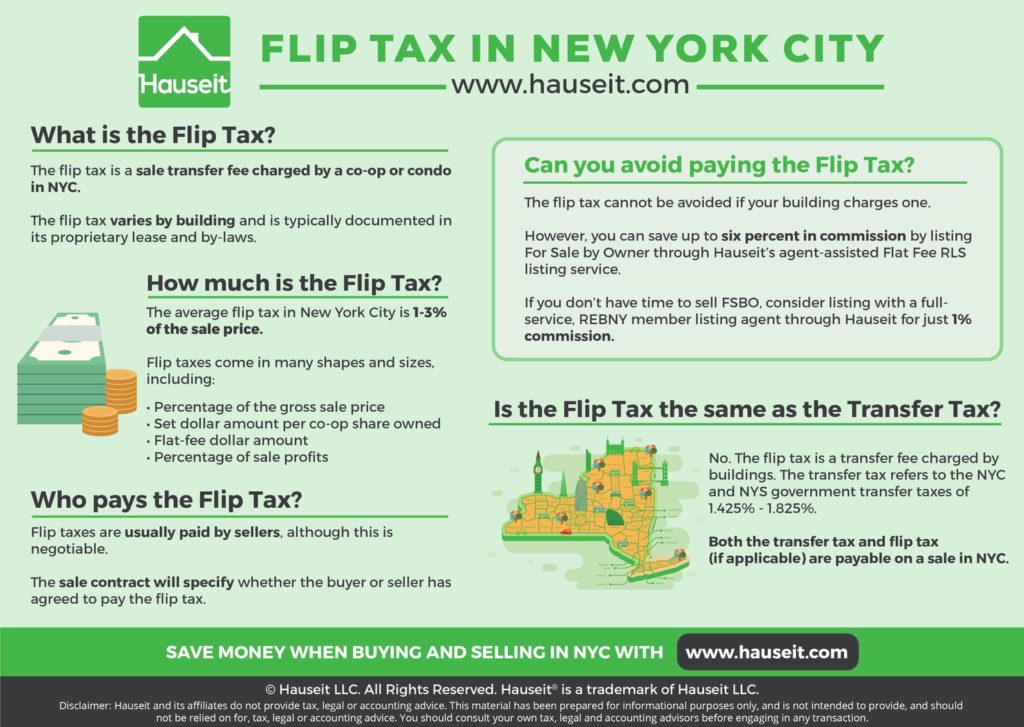

Flip Tax In Nyc What Is The Average Flip Tax And Who Pays It Hauseit